28+ Online income tax calculator

This marginal tax rate means that your immediate additional income will be taxed at this rate. 10 of Income Tax in case taxable income is above 50 lacs.

Xtool D7 Auto Obd2 Scanner Full Systems Diagnostic Key Programmer 28 Services Ebay

PLEASE PROVIDE ME.

. Residents of Arkansas face sales tax rates that are among the highest in the country. German Income tax - Personal Income Tax. For residents standard deductions exist to help lower your taxable income with some of the most common ones being the personal relief and the lifestyle relief.

285 cents per gallon of diesel. Add lines 28 and 29. State income taxes which vary by state are an amount of money that you pay to the state government based on a percentage of the income you earn.

The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the 2022 Tax Assessment year 1 st January 2022 - 31 st December 2022. 25 of Income Tax in case taxable income is above 2 crore. This puts you in the 25 tax bracket since thats the highest rate applied to any of your income.

Multiply line 30 by 20. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. 4 of Income Tax Surcharge.

According to the Tax Foundation the. 15 January 2022 - Due date for filing of audit report under section 44AB for the assessment year 2021-22 in the case of a corporate-assessee or non-corporate assessee who was required to submit hisits return of income on October 31 2021. The new effective tax rate would be 28 effective for tax years beginning after December 31 2022.

Today itself download a free demo of GEN IT. Tax rates are used to work out how much tax you need to pay on your total income for the year from all sources. Estimate your tax refund with HR Blocks free income tax calculator.

37 of Income Tax in case taxable income is above 5 crore. Compliance and filing requirements for individuals. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

State tax is levied on your income each year. January 22 2022 at 1021 am. Gen IT software also explains the procedure of how to file income tax returns online for a salaried employee.

Karnataka road tax first came into being in 1957 under the Karnataka Motor Vehicles Taxation Act. You can include your income Capital Gains Overseas Pensions Donations to charity and allowances for family members. AJAY KUMAR JHA says.

Health Education Cess. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. H and R block Skip to content.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Online tax withholding calculator 2021 is based on an excel spreadsheet named Income Tax Withholding Assistant to help small employers compute the amount of federal income tax to withhold from their employees wages.

Your household income location filing status and number of personal exemptions. Your household income location filing status and number of personal exemptions. PLEASE SIR SEND ME OF FULL VERSION OF EXCEL SHEET OF SALARY FY-2021-22.

This next calculator lets you try it out with your own numbers. The income tax calculator for Poland allows you to select the number of payroll payments you receive in a year this could be 12 1 a month 13 with bonus 14 with additional payments or more you can choose the number of payroll payments in the year to produce an annual income tax calculation. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

A road tax is nothing but a form of taxation which all motor-vehicle owners need to bear in Karnataka and all other states of India. Total qualified REIT and PTP income. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

The Tax year for Individuals is the same as the calendar year from 1 January to 31 December. The income tax return ITR form used by many if not most salaried individuals is ITR-1. January 28 2022 at 357 pm.

The due date for filing of audit report for Assessment Year 2021-22 has been extended vide Circular no. Our income tax calculator calculates your federal state and local taxes based on several key inputs. 285 cents per.

15 of Income Tax in case taxable income is above 1 crore. The Entity Selection Calculator is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the Qualified Business Income QBI deduction. Your average tax rate is 165 and your marginal tax rate is 297.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. Tax codes only apply to individuals. May 28 2020 at 440 pm pl provide demo as soon as possible.

They help your employer or payer work out how much tax to deduct before they pay you. This excel spreadsheet is published on IRS websiteFurther the spreadsheet is designed to help employers for the transition to the new. If you are filing a tax return individually they generally are due by 31st July of next year following the tax year end.

Enter your details to estimate your salary after tax. Use our income tax calculator to find out what your take home pay will be in Washington for the tax year. This ITR form is also known as Sahaj.

Individuals pay progressive tax rates. But as a percentage of the whole 100000 your tax is about 17. Once you have produce your income tax.

The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023. Limits on family partners to shift tax basis. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US.

REIT and PTP component. ITR-1 is probably the easiest form to fill since it requires information about income from a limited number of sources such as salary house property etc. Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes.

Tax Planning in the beginning of the Financial Year is always bet. Type of federal return filed is based on your personal tax situation and IRS rules. QBI deduction before the.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Want to know more about the Missouri income tax rate. This means you pay a graduated amount depending on how much income you get.

February 28 2018 at participating offices to qualify. For taxable years that begin after January 1 2022 and before January 1 2023 only the portion of the taxable year in 2023 would be subject to the 28 tax rate. Even though the same Act is still followed it has undergone several amendments since then the latest being in 2014.

March 1 2020 at 1151 pm SIR I WANT TO INCOME TAX AND 10E FORM SOFTWARE CALCULATOR. Simple Income Tax Calculator for the Financial Year 2021-22 in Excel for Salaried Individuals. Your household income location filing status and number of personal exemptions.

Missouri levies a personal income tax on residents and nonresidents with Missouri-income. As far as tax credits go which help directly. If ITR-1 is filed completely online on the new income tax portal then most of the.

This income tax calculator can help estimate your average income tax rate and your take home pay.

Thinkcar Thinkscan Max Obd2 Scanner Diagnotic Tool All System 28 Reset Functions Ebay

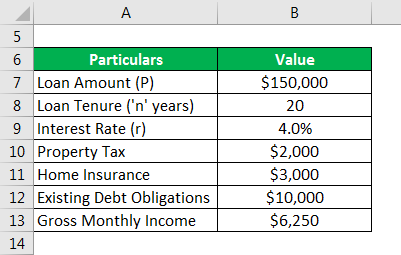

Total Debt Service Ratio Explanation And Examples With Excel Template

North Carolina Appraisal Continuing Education License Renewal Mckissock Learning

Real Estate Commission Calculator Templates 8 Free Docs Xlsx Pdf Real Estate Real Estate Infographic Real Estate Agent

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Total Debt Service Ratio Explanation And Examples With Excel Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Total Debt Service Ratio Explanation And Examples With Excel Template

Sales Forecast Templates 15 Free Ms Docs Xlsx Pdf Templates Excel Templates Forecast

Payslip Templates 28 Free Printable Excel Word For Writing Practice Worksheets Kindergarten Subtraction Worksheets Kindergarten Worksheets Free Printables

Tinkcar Obd2 Scanner Full System Diagnostic Tools With 28 Special Functions 10 Ebay

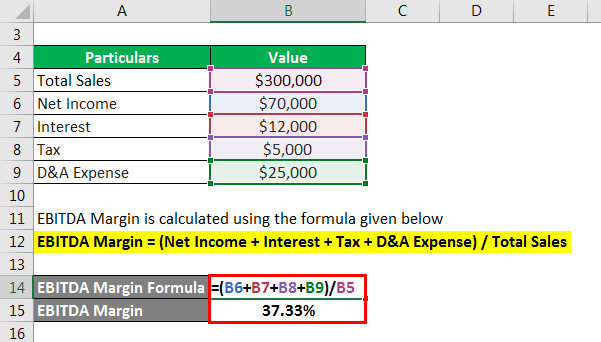

Ebitda Margin Formula Example And Calculator With Excel Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

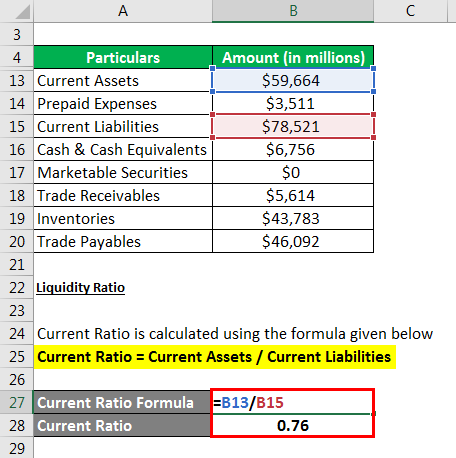

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Word Template

Building Maintenance Checklist Templates 7 Free Docs Xlsx Pdf Maintenance Checklist Checklist Template Checklist

Thinkcar Thinktool Pro Car Full System Obd2 Diagnostic Scanner Ecu Coding Tool Ebay